Managing finances in a large company can be complex. Budgeting software helps simplify this task.

QuickBooks is a popular choice for many businesses. But finding software that integrates well with QuickBooks is key. In this blog post, we will explore ten enterprise budgeting software solutions that work seamlessly with QuickBooks. These tools can make budgeting more efficient and accurate for your business.

Integration with QuickBooks ensures that all financial data is in one place. This can save time and reduce errors. Whether you’re seeking better financial control or more detailed reporting, these software solutions can help. Keep reading to discover the best options for your enterprise needs.

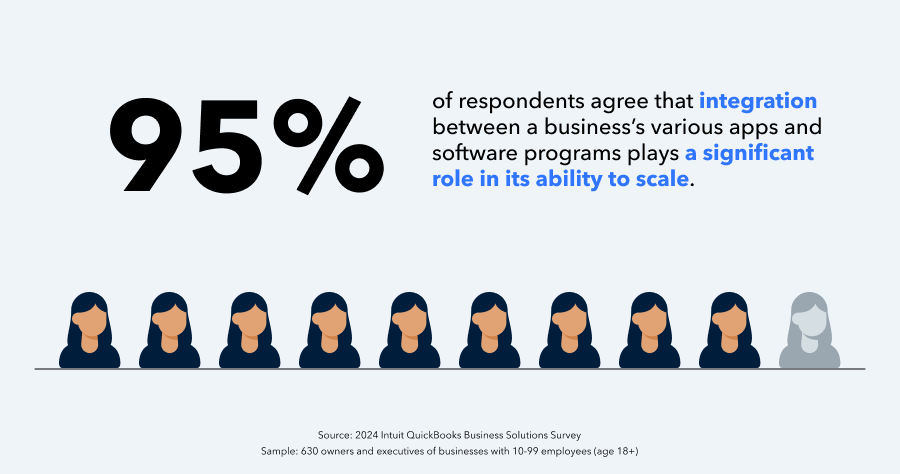

Credit: quickbooks.intuit.com

Table of Contents

ToggleAdaptive Planning

Adaptive Planning is a robust enterprise budgeting software. It integrates seamlessly with QuickBooks. This software helps businesses manage financial planning, budgeting, and forecasting efficiently. Let’s explore its key features and integration process.

Key Features

- Flexible Budgeting: Create detailed budgets with ease.

- Forecasting: Generate accurate forecasts to guide business decisions.

- Reporting: Access real-time reports and dashboards.

- Collaboration: Share data and collaborate with team members.

- Scalability: Suitable for businesses of all sizes.

Integration Process

Integrating Adaptive Planning with QuickBooks is straightforward. Follow these steps:

- Connect Accounts: Link your QuickBooks account to Adaptive Planning.

- Data Sync: Sync your financial data automatically.

- Customize Mapping: Map your accounts to match your budgeting structure.

- Review Data: Ensure all data is accurate and up-to-date.

- Start Planning: Begin using Adaptive Planning for budgeting and forecasting.

This integration simplifies financial management. It ensures your data is always current and accurate. Adaptive Planning is an ideal choice for businesses seeking efficiency and accuracy.

Prophix

Prophix is a leading enterprise budgeting software solution that integrates with QuickBooks. It helps businesses streamline their financial planning and budgeting processes. With Prophix, you can make informed decisions and improve financial performance.

Highlights

Prophix offers a range of features to enhance your budgeting experience. It provides automated financial reporting, which saves time and reduces errors. You can create detailed budgets and forecasts easily. Prophix also supports complex budgeting scenarios and allows for advanced data analysis.

Another highlight is the user-friendly interface. It is intuitive and easy to navigate. This ensures that both financial experts and non-experts can use the software effectively. Prophix also offers strong security measures to protect your financial data.

Compatibility With Quickbooks

Prophix integrates seamlessly with QuickBooks. This integration allows for real-time data synchronization. You can import and export data between Prophix and QuickBooks without hassle. This ensures that your financial information is always up-to-date.

The integration also simplifies the budgeting process. You can use the data from QuickBooks to create accurate budgets in Prophix. This makes financial planning more efficient and less time-consuming. The compatibility with QuickBooks makes Prophix a powerful tool for any business.

Vena Solutions

Vena Solutions is a popular enterprise budgeting software. It helps businesses plan, budget, and forecast. Vena integrates well with QuickBooks, simplifying financial management. Many companies use Vena for its powerful features and ease of use.

Main Benefits

Vena Solutions offers several benefits for businesses. It improves budgeting accuracy. Teams can collaborate easily. The software also provides real-time data. This helps in making informed decisions. Vena’s interface is user-friendly. This makes it easy for anyone to use.

Another benefit is its flexibility. Vena adapts to different business needs. It supports multiple budgeting scenarios. This helps in planning for various outcomes. Vena also has strong security features. This ensures data privacy and protection.

Quickbooks Integration Steps

Integrating Vena with QuickBooks is simple. Follow these steps to connect the two systems:

- First, log in to your Vena account.

- Go to the ‘Integrations’ section.

- Select ‘QuickBooks’ from the list of options.

- Enter your QuickBooks credentials.

- Authorize Vena to access your QuickBooks data.

- Choose the data you want to sync.

- Click ‘Sync’ to complete the integration.

These steps ensure a smooth connection. Vena and QuickBooks will now work together seamlessly. This integration saves time and reduces errors.

Centage Budget Maestro

Centage Budget Maestro is a robust enterprise budgeting software. It integrates seamlessly with QuickBooks. It helps businesses streamline their financial planning. This tool offers real-time insights and accurate forecasting. It is designed for both small and large enterprises.

Core Features

Centage Budget Maestro offers several key features:

- Automated Budgeting: Reduces manual errors and saves time.

- Forecasting: Provides reliable financial forecasts.

- Reporting: Customizable reports for various needs.

- Scenario Analysis: Helps in evaluating multiple financial scenarios.

- Dashboard: User-friendly and interactive dashboard.

These features make Centage Budget Maestro a powerful tool. It helps in effective financial planning and management.

Integration Workflow

Integrating Centage Budget Maestro with QuickBooks is straightforward:

- Setup: Connect your QuickBooks account with Centage.

- Data Sync: Automatically sync financial data between the two platforms.

- Customization: Customize the integration settings as per your needs.

- Validation: Verify the data to ensure accuracy.

- Usage: Start using the integrated data for budgeting and forecasting.

This workflow ensures a smooth and efficient integration. It allows businesses to leverage the strengths of both tools.

Solver

Solver is a powerful enterprise budgeting software solution that integrates seamlessly with QuickBooks. Designed for businesses of all sizes, it offers a comprehensive suite of features to manage budgets, forecasts, and financial reports with ease.

Unique Selling Points

Solver stands out due to its user-friendly interface and robust capabilities. It supports:

- Advanced Reporting: Create detailed financial reports effortlessly.

- Scalability: Suitable for small businesses and large enterprises.

- Customizable Dashboards: Tailor dashboards to meet specific business needs.

- Real-Time Data: Access up-to-date financial information anytime.

- Collaboration Tools: Enable team collaboration on budget planning.

Connecting With Quickbooks

Solver integrates seamlessly with QuickBooks, ensuring smooth data synchronization. Here’s how it connects:

- Direct Integration: Sync data directly from QuickBooks without manual entry.

- Automated Updates: Keep Solver updated with the latest financial data from QuickBooks.

- Data Accuracy: Minimize errors with automated data transfer.

- Enhanced Analysis: Use QuickBooks data for in-depth financial analysis within Solver.

Solver’s integration with QuickBooks ensures that your budgeting process is efficient and accurate. This connection saves time and reduces the risk of errors, making it a valuable tool for any business.

Host Analytics

Host Analytics stands out as a powerful enterprise budgeting software. This tool integrates seamlessly with Quickbooks, making financial management easier. It offers a range of features that help businesses streamline their budgeting processes. Let’s explore the advantages and integration capabilities of Host Analytics.

Advantages

Host Analytics provides real-time financial insights. This helps businesses make informed decisions quickly. The software supports detailed financial planning and analysis. Users can create accurate budgets and forecasts with ease. The user-friendly interface ensures that even non-experts can navigate the tool.

Host Analytics enhances collaboration across departments. Teams can work together on budget planning without confusion. The software also supports scenario planning. This allows businesses to prepare for various financial situations. Additionally, Host Analytics offers robust reporting features. Users can generate comprehensive reports to track financial performance.

Seamless Integration

Integration with Quickbooks is effortless with Host Analytics. Data synchronization between the two platforms is automatic. This ensures that financial information is always up-to-date. Users do not need to manually transfer data, reducing errors.

The integration process is straightforward. Businesses can set it up without extensive technical knowledge. Host Analytics supports multiple data formats. This flexibility ensures that different types of financial data can be integrated smoothly. The seamless integration improves overall efficiency. It allows businesses to focus on strategic planning rather than data management.

Jedox

Jedox is a powerful enterprise budgeting software solution that integrates seamlessly with QuickBooks. It offers a range of features designed to streamline financial planning, budgeting, and forecasting processes. With Jedox, businesses can enhance their financial operations and make informed decisions with ease.

Primary Features

- Comprehensive Planning and Budgeting: Jedox provides advanced tools for creating detailed budgets and financial plans.

- Data Integration: It easily integrates data from various sources, ensuring a unified view of financial information.

- Real-time Reporting: Generate real-time reports and dashboards to track financial performance.

- Collaboration: Teams can collaborate efficiently with built-in workflow and approval processes.

- Scalability: Suitable for businesses of all sizes, from small enterprises to large corporations.

Quickbooks Compatibility

Jedox integrates effortlessly with QuickBooks. This ensures that your financial data remains synchronized and up-to-date. Here are the key aspects of its compatibility:

| Compatibility Aspect | Description |

|---|---|

| Data Sync | Automatically syncs data between Jedox and QuickBooks, minimizing manual entry. |

| Real-time Updates | Reflects real-time changes in both systems, ensuring data accuracy. |

| Seamless Integration | Integrates with QuickBooks through a user-friendly interface. |

| Enhanced Reporting | Combines data from both platforms for comprehensive financial reports. |

Using Jedox with QuickBooks offers a unified financial management solution. This helps businesses maintain accurate and up-to-date financial records.

Credit: signeasy.com

Planful

Planful is a robust enterprise budgeting software. It seamlessly integrates with QuickBooks. This tool helps businesses streamline their financial planning. It is designed to simplify complex budgeting tasks. Planful is ideal for companies aiming to enhance their financial efficiency.

Key Attributes

Planful offers several key features:

- Automated Forecasting: Reduces manual effort and errors.

- Collaborative Budgeting: Allows multiple users to work simultaneously.

- Scenario Analysis: Provides insights into various financial outcomes.

- Real-time Data: Ensures up-to-date financial information.

- Customizable Reports: Tailored to meet specific business needs.

Integration Details

Planful integrates smoothly with QuickBooks. This integration offers:

| Feature | Description |

|---|---|

| Data Sync | Automatically syncs financial data between systems. |

| Single Sign-On | Access both tools with one set of credentials. |

| Unified Dashboard | View QuickBooks data within Planful’s interface. |

| Error Reduction | Minimizes errors by eliminating manual data entry. |

| Time Savings | Saves time on financial reporting and analysis. |

Integrating Planful with QuickBooks enhances financial planning. It streamlines operations and improves accuracy. Businesses benefit from real-time data and better decision-making tools.

Workday Adaptive Planning

Workday Adaptive Planning is a robust enterprise budgeting software. It offers powerful planning, budgeting, and forecasting tools. This software helps businesses streamline their financial processes. Workday Adaptive Planning integrates smoothly with QuickBooks, making it a preferred choice for many enterprises.

Major Benefits

Workday Adaptive Planning has many key benefits. It provides real-time data insights. This helps businesses make better financial decisions. The software offers advanced modeling capabilities. Users can create and modify financial plans easily. It also supports collaboration across teams. This ensures everyone is on the same page. The software is scalable. It grows with your business needs. Workday Adaptive Planning also enhances accuracy. This reduces the risk of errors in financial data.

Quickbooks Integration

Workday Adaptive Planning integrates seamlessly with QuickBooks. This integration streamlines the budgeting process. It allows for easy data transfer between the two systems. Users can sync financial data without manual entry. This saves time and reduces errors. QuickBooks integration also ensures consistency. Financial data remains up-to-date across both platforms. This integration helps businesses maintain accurate financial records. It simplifies the overall budgeting and planning process.

Credit: www.airbase.com

Board

Board is a powerful enterprise budgeting software solution that integrates seamlessly with QuickBooks. It offers a comprehensive suite of features designed to streamline your budgeting processes and improve financial planning. This section explores the key features and integration capabilities of Board, making it an excellent choice for businesses looking to enhance their budgeting efficiency.

Features Overview

Board provides a wide array of features to support enterprise budgeting and planning:

- Interactive Dashboards: Visualize data with customizable dashboards.

- Advanced Analytics: Gain insights through predictive analytics and forecasting.

- Collaborative Planning: Enable team collaboration for more accurate budgets.

- Data Integration: Seamlessly integrate data from multiple sources.

- Reporting Tools: Generate detailed financial reports easily.

Integration Capabilities

Board offers robust integration capabilities with QuickBooks:

- Real-Time Data Sync: Ensure data consistency with real-time synchronization.

- Automated Workflows: Automate data transfer and reduce manual entry.

- Customizable Connectors: Tailor the integration to fit your business needs.

These integration features make Board a versatile and efficient solution for businesses using QuickBooks. The seamless connectivity ensures that your financial data is always up-to-date, allowing for more accurate budgeting and forecasting.

Frequently Asked Questions

What Are Enterprise Budgeting Software Solutions?

Enterprise budgeting software solutions help large organizations manage their budgets effectively. They offer features like forecasting, reporting, and integration with accounting tools like QuickBooks.

How Do These Software Solutions Integrate With Quickbooks?

These software solutions seamlessly integrate with QuickBooks through APIs. This allows for automatic syncing of financial data, ensuring accuracy and reducing manual entry.

Why Choose Software That Integrates With Quickbooks?

Choosing software that integrates with QuickBooks ensures streamlined financial management. It reduces errors, saves time, and provides real-time financial insights.

What Features Should I Look For?

Look for features like automation, real-time reporting, forecasting, and user-friendly interfaces. Integration with existing tools and scalability are also important.

Conclusion

Finding the right budgeting software is crucial for business success. The tools listed integrate seamlessly with QuickBooks. This makes managing finances simpler and more efficient. Each option offers unique features to meet diverse needs. Evaluate them carefully to find the best fit.

Better financial planning leads to better business outcomes. Start exploring these software solutions today and streamline your budgeting process. Keep your business growing with these powerful tools.

Related posts:

No related posts.