Invoicing is crucial for small businesses. It ensures cash flow and keeps operations smooth.

Managing invoices can be done manually or with automation. Both methods have their pros and cons. Small business owners often struggle to choose the best option. Understanding the costs and benefits is key. Automated invoicing uses software to handle tasks.

It saves time but may have upfront costs. Manual invoicing involves more hands-on work. It is often cheaper but can be time-consuming. This blog post will explore both methods. You’ll learn the advantages and disadvantages of each. By the end, you will know which method suits your business needs best. Stay tuned to make an informed choice for your invoicing process.

Table of Contents

ToggleIntroduction To Invoicing

Invoicing is an essential part of running a small business. It helps track sales and ensures you get paid on time. Understanding invoicing can improve your cash flow and financial management. This section explores the basics of invoicing and its importance for small businesses.

Importance Of Invoicing

Invoicing is crucial for several reasons. It helps maintain a record of sales and services. Accurate invoices ensure you get paid promptly. They also help in managing cash flow and taxes.

Here are some key points on why invoicing is important:

- Financial Record Keeping: Invoices provide a record of transactions.

- Cash Flow Management: Timely invoices help maintain steady cash flow.

- Tax Compliance: Proper invoices simplify tax calculations and compliance.

- Professionalism: Well-prepared invoices show professionalism to clients.

Common Invoicing Methods

Small businesses use various invoicing methods. The two main types are manual and automated invoicing.

Let’s look at both methods:

| Method | Description | Pros | Cons |

|---|---|---|---|

| Manual Invoicing | Creating invoices by hand or using basic software like Excel. |

|

|

| Automated Invoicing | Using specialized software to generate and send invoices automatically. |

|

|

Choosing the right method depends on your business needs and budget. Automated invoicing offers efficiency and error reduction. Manual invoicing is cost-effective but can be time-consuming.

Automated Invoicing

Automated Invoicing has become an essential tool for small businesses. It simplifies the invoicing process and reduces manual errors. By automating invoicing, businesses can save time and money. Let’s explore how automated invoicing works and its key features.

How Automated Invoicing Works

Automated invoicing uses software to generate and send invoices. The process is streamlined and efficient. Here’s how it works:

- The software extracts data from your accounting system.

- It creates an invoice based on predefined templates.

- The invoice is sent automatically to the client via email.

- Payment reminders are scheduled if the invoice remains unpaid.

- Payments are tracked and recorded in real-time.

This process eliminates manual entry and minimizes errors. It ensures invoices are sent promptly and accurately.

Key Features Of Automated Systems

Automated invoicing systems come with various features that benefit small businesses. Here are some key features:

- Customizable Templates: Create professional-looking invoices tailored to your brand.

- Recurring Invoices: Set up recurring invoices for regular clients.

- Payment Tracking: Monitor the status of invoices and payments in real-time.

- Automated Reminders: Send automatic reminders for overdue payments.

- Integration with Accounting Software: Sync seamlessly with your existing accounting tools.

- Secure Data Storage: Keep your invoicing data safe and accessible.

These features streamline the invoicing process, improve cash flow, and enhance customer relationships. Small businesses can focus on growth rather than administrative tasks.

Manual Invoicing

Manual invoicing has been a traditional method for many small businesses. This process involves creating invoices by hand or using simple software. While it is straightforward, it comes with its own set of challenges.

Process Of Manual Invoicing

Manual invoicing starts with gathering all necessary information. This includes the client’s name, address, and details of the goods or services provided. Next, the invoice is written or typed out, either by hand or with basic software like Excel or Word.

Once the invoice is created, it needs to be sent to the client. This can be done via mail or email. After sending, the business must wait for the client to process and pay the invoice. The payment then needs to be recorded manually in the books.

Challenges In Manual Invoicing

Manual invoicing can be time-consuming. Creating and sending each invoice individually takes a lot of effort. Small errors can also occur easily. Mistakes in calculations or data entry can lead to disputes and delays in payments.

Tracking invoices manually is difficult. Businesses must maintain organized records to ensure they know which invoices are paid and which are pending. This is especially challenging as the business grows and the number of invoices increases.

Additionally, manual invoicing lacks automation features. This means no automatic reminders for overdue payments. Businesses must follow up with clients manually, which can be tedious and time-consuming.

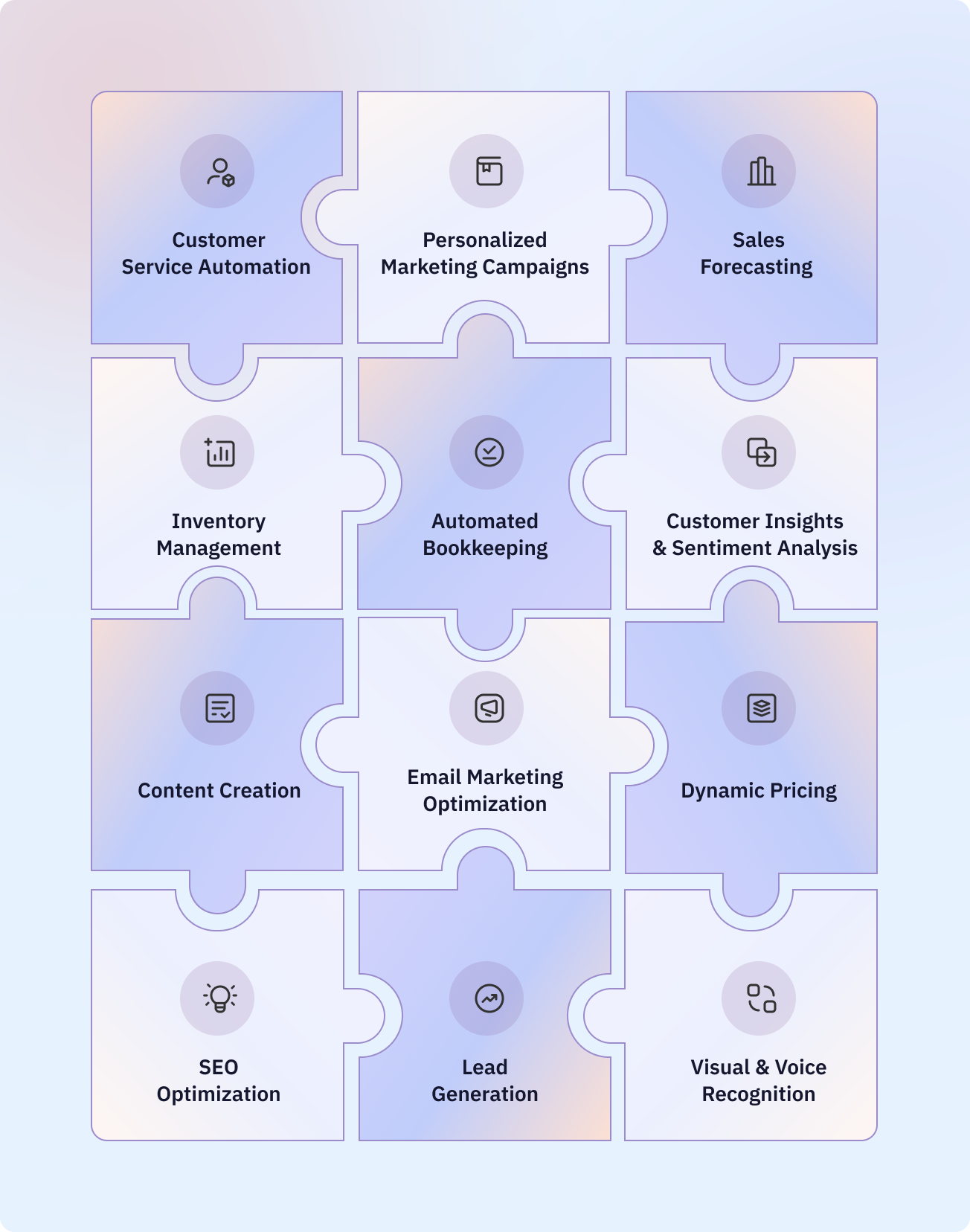

Credit: litslink.com

Cost Comparison

Small businesses often weigh the costs of automated invoicing versus manual invoicing. Understanding the cost differences can help in making an informed decision. Here is a detailed cost comparison focusing on upfront costs and long-term savings.

Upfront Costs

Automated invoicing systems require an initial investment in software or subscriptions. These costs can vary based on the features and the number of users.

| Expense Type | Automated Invoicing | Manual Invoicing |

|---|---|---|

| Software Purchase | $200 – $500 | $0 |

| Subscription Fees | $20 – $50/month | $0 |

| Training | $50 – $200 | $0 |

Manual invoicing has no software costs. Still, it involves buying paper, pens, and other office supplies. These might seem small, but they add up over time.

Long-term Savings

Automated invoicing saves time and reduces errors. This can lead to significant long-term savings. Fewer errors mean fewer disputes and faster payments.

- Time Savings: Automation can reduce invoicing time by up to 80%.

- Reduced Errors: Automation reduces human errors, which can be costly.

- Efficiency: Automated reminders ensure timely payments.

Manual invoicing might seem cheaper initially. Yet, it consumes more time and is prone to errors. This can lead to delayed payments and disputes, which are costly.

- Time-Consuming: Manual invoicing takes more time.

- Error-Prone: Human errors can lead to costly mistakes.

- Delayed Payments: Manual processes can delay payments.

Time Efficiency

Time efficiency is crucial for small businesses. Every minute saved can be used for other important tasks. Automated invoicing can significantly reduce the time spent on administrative tasks, offering a distinct advantage over manual invoicing.

Processing Speed

Automated invoicing processes invoices faster than manual methods. A few clicks can generate and send invoices. No need to fill out forms by hand. Automated systems streamline the entire process. This frees up valuable time for other business activities.

Error Reduction

Errors in invoicing can be costly and time-consuming. Automated invoicing reduces errors significantly. The system automatically calculates totals and taxes. This minimizes the risk of human error. Less time spent correcting mistakes means more time for growth.

Credit: www.avidxchange.com

Scalability

Scalability is crucial for small businesses aiming for growth. The ability to handle increased operations efficiently can determine success. Automated and manual invoicing systems offer different levels of scalability. Understanding their strengths and weaknesses helps businesses make informed decisions.

Handling Increased Volume

Manual invoicing struggles with increased volume. Each invoice requires individual attention. This process is time-consuming and error-prone. Mistakes can delay payments and damage customer relationships.

Automated invoicing handles large volumes effortlessly. The system processes invoices quickly and accurately. It reduces errors and speeds up payment cycles. This efficiency saves time and money.

Adaptability To Business Growth

Manual invoicing lacks adaptability. Scaling requires more staff and resources. This increases costs and complexity. The risk of human error also grows with volume.

Automated invoicing adapts easily to business growth. The system scales without additional resources. It adjusts to new requirements smoothly. Businesses can focus on core activities, not administrative tasks.

| Aspect | Manual Invoicing | Automated Invoicing |

|---|---|---|

| Handling Increased Volume | Time-consuming and error-prone | Quick and accurate processing |

| Adaptability to Business Growth | Requires more resources | Scales effortlessly |

Choosing the right invoicing system impacts growth. Automated systems offer scalability and efficiency. They provide a competitive edge in a growing market.

Security And Compliance

In today’s digital age, security and compliance are crucial for small businesses. When considering automated vs manual invoicing, these aspects can greatly impact your decision. This section delves into the important factors of data protection and regulatory compliance.

Data Protection

Data breaches can cause severe financial and reputational damage. Automated invoicing systems often come with advanced security features:

- Encryption

- Two-factor authentication

- Regular security updates

These features help secure sensitive information, reducing the risk of data breaches. In contrast, manual invoicing involves physical documents and human handling. This increases the risk of:

- Document loss

- Unauthorized access

- Human errors

To protect client data, automated systems can be the safer choice.

Regulatory Compliance

Meeting regulatory standards is essential for legal and financial stability. Automated invoicing software often includes features to ensure compliance:

- Tax calculations

- Document retention

- Audit trails

These tools help businesses adhere to local and international regulations. Manual invoicing requires meticulous record-keeping and a thorough understanding of compliance laws. This can be time-consuming and prone to mistakes.

Automated systems can save time and reduce the risk of non-compliance, offering peace of mind.

Choosing The Right System

Selecting the best invoicing method is crucial for small businesses. It impacts efficiency and cost-effectiveness. Here, we explore key factors to help make an informed decision.

Assessing Business Needs

Start by understanding your business requirements. Ask yourself these questions:

- How many invoices do you send monthly?

- Do you need to track payments?

- Is customization of invoices important?

- How much time can you dedicate to invoicing?

Small businesses with high invoice volumes may benefit more from automation. Manual invoicing can be a good choice for lower volumes or highly customized invoices.

Evaluating Available Solutions

Compare the features of manual and automated invoicing solutions. Consider:

| Feature | Manual Invoicing | Automated Invoicing |

|---|---|---|

| Time Required | High | Low |

| Error Rate | Higher | Lower |

| Initial Cost | Low | Varies |

| Scalability | Low | High |

Manual invoicing is often cheaper initially but may cost more in the long run. Automated systems usually have higher upfront costs but save time and reduce errors.

In summary, the right choice depends on your specific needs and resources. Assess your business requirements and evaluate available solutions carefully.

Implementation Tips

Making the switch from manual to automated invoicing can streamline your business operations. But, it requires careful planning. Ensuring a smooth transition and proper staff training is crucial. Here are some tips to help with implementation:

Smooth Transition Strategies

First, evaluate your current invoicing process. Identify areas that need improvement. Choose an invoicing software that fits your business needs.

Next, set a clear timeline for the transition. Inform your team about the changes. This helps in managing expectations and reducing resistance.

Start with a pilot test. Implement the new system in a small part of your business. Monitor the results. Make adjustments as needed. This reduces the risk of major disruptions.

Ensure that your data is accurate before migrating. Clean up any errors. This ensures that the new system works smoothly from the start.

Training Staff

Training is essential for a successful transition. Begin with basic training sessions. Cover the key features of the new software.

Use simple language. Ensure that all staff understand the instructions. Provide hands-on training. Allow staff to practice using the new system.

Create user guides and FAQs. These resources can help staff troubleshoot common issues. Encourage staff to ask questions. Offer continuous support during the transition period.

Finally, track staff progress. Provide feedback and additional training if needed. This ensures that everyone is comfortable with the new system.

Credit: www.infotech.com

Frequently Asked Questions

What Is Automated Invoicing?

Automated invoicing uses software to generate and send invoices automatically. It helps save time, reduces errors, and streamlines the billing process.

How Does Manual Invoicing Work?

Manual invoicing involves creating and sending invoices by hand, usually using templates or spreadsheets. It requires more time and is prone to human errors.

Which Is Cheaper: Automated Or Manual Invoicing?

Initially, manual invoicing may seem cheaper. However, automated invoicing saves time and reduces errors, leading to long-term cost savings.

What Are The Benefits Of Automated Invoicing?

Automated invoicing offers time savings, fewer errors, quicker payments, and better financial management. It improves overall efficiency for small businesses.

Conclusion

Automated invoicing offers efficiency and accuracy for small businesses. It saves time and reduces errors. Manual invoicing can be more flexible but is time-consuming. Both methods have pros and cons. Small businesses must assess their needs and resources. Cost savings and ease of use are vital.

Choosing the right invoicing method impacts growth. Think about your business size, budget, and goals. Make an informed decision. The right choice will streamline operations and improve cash flow.